2017 might end up being a difficult year for online marketers. The new looming GDPR which may replace the current Data Protection policies are going to certainly hurt. Now the chancellor may have some more pain to add.

Normally the UK Budget isn’t something that we endeavour to cover. However I was scrolling through a few stories on what to expect and this line caught my eye and set of my “Spidey” sense:

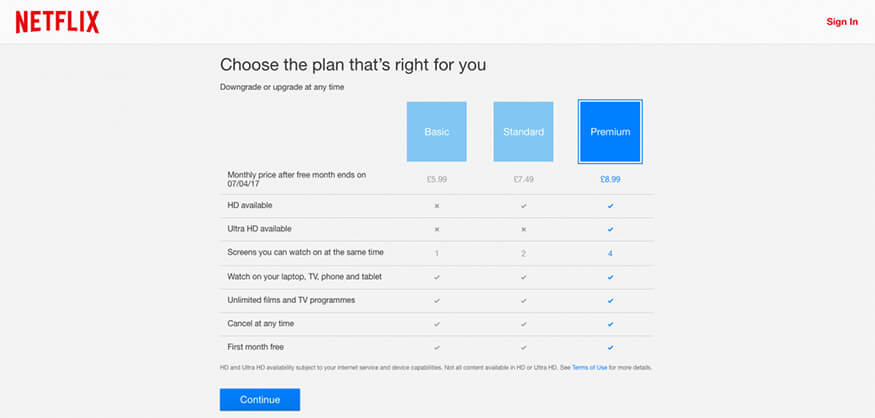

Also an end to deals where customers are offered a free trial, asked for their payment details and then fail to cancel in appropriate time and get billed, as used by the likes of Amazon and Netflix. – news.sky.com

I looked over a couple of sources and saw that there was more coverage a few days ago:

Plans to cut confusing small print and end the cycle of ‘subscription traps’ will be set out in next week’s Budget. – BBC

What’s Are Subscription Traps?

Subscription traps are a serious technique employed by both, legitimate businesses such as Netflix and Amazon as highlighted above, as well as a whole host of online marketers, growth hackers – they are a great way to boost up conversions by offering a free trial.

40 per cent of British people are paying for a subscription that they do not use

The conversion trap of course, is that the “free trial” is only offered if you give up your payment details. Its then up to you as a consumer to cancel your subscription before your free trial period ends. This actually, is a very popular “go to” conversion optimisation technique utilised by SAAS companies.

Subscription Traps are powered by what is called a Continuous Payment Authority or CPA for short – which is handing over your payment details, via the phone or in person or online, without setting any terms as you would with direct debits. The issue with CPAs in general is that they differ massively from direct debits. In essence, by giving a company a CPA, you are authorising the company to take a payment, at any time, for whatever amount – the CPA isn’t linked to a figure or a time. This makes them ideal for scammers.

Why Target CPAs and Subscription Traps?

Unfortunately a large number of online scammers use this methodology to sell a whole host of useless subscriptions. You must have seen the ads when you are reading online, from “Magic Tips to Lose Belly Fat” to “Miracle Cures For X” – a large number of these online scam merchants tend to use the subscription trap, but also go a bit further by making it difficult to cancel. See this case for an example.

However even legitimate businesses offering “free trials” may inadvertently be adding to consumer stress. The problem is of course, on general terms, people are just too complacent – this is a consumer issue – I have fallen into that trap many times – sign up for X – forget to cancel on time and lose a month or two worth of fees till I realise. Then there are those trials such as Amazon Prime which takes out a whole years membership once the free trial period is over. Gyms are notorious for using this technique too, and difficult to get out of once you have a contract.

The chancellor has taken up to be the champion of the consumer and penalise businesses – citing “poor or difficult” terms and conditions when these subscription traps as initiated.

I would argue actually most legitimate businesses who offer free trials which ask for payment info beforehand are probably doing it the right way. The problem is about consumer education.

What Will Happen?

Well we wont know till much later on today as the budget is announced. However one thing is clear, expect your conversion rates to suffer and be prepared to rebuild your customer on-boarding journeys.

Will It Work?

If a law is passed, then most certainly UK consumers may be slightly better protected, even if its from their own lethargy. However it remains to be seen how the law deals with the two major scenarios below:

B2B and SAAS – in most cases B2B products and marketing have completely different rules and regulations to those faced by B2C marketers. In many cases the law is a lot more relaxed. Would the law and guidance around subscription traps differentiate between B2B and B2C? In one case, a business man had to go to court after being charged for a useless membership of his guild.

International Players – how does the chancellor envision dealing with international firms with no presence in the UK at all? A large number of the scam merchants that use this technique are based in or operate from locations that have lax laws. They also use payment gateways and systems built for purpose and often sheltered from the law of most lands.

Make sure you follow us on Twitter and LinkedIn – as soon as we hear more we will try adding some more clarity on this post.